Introduction

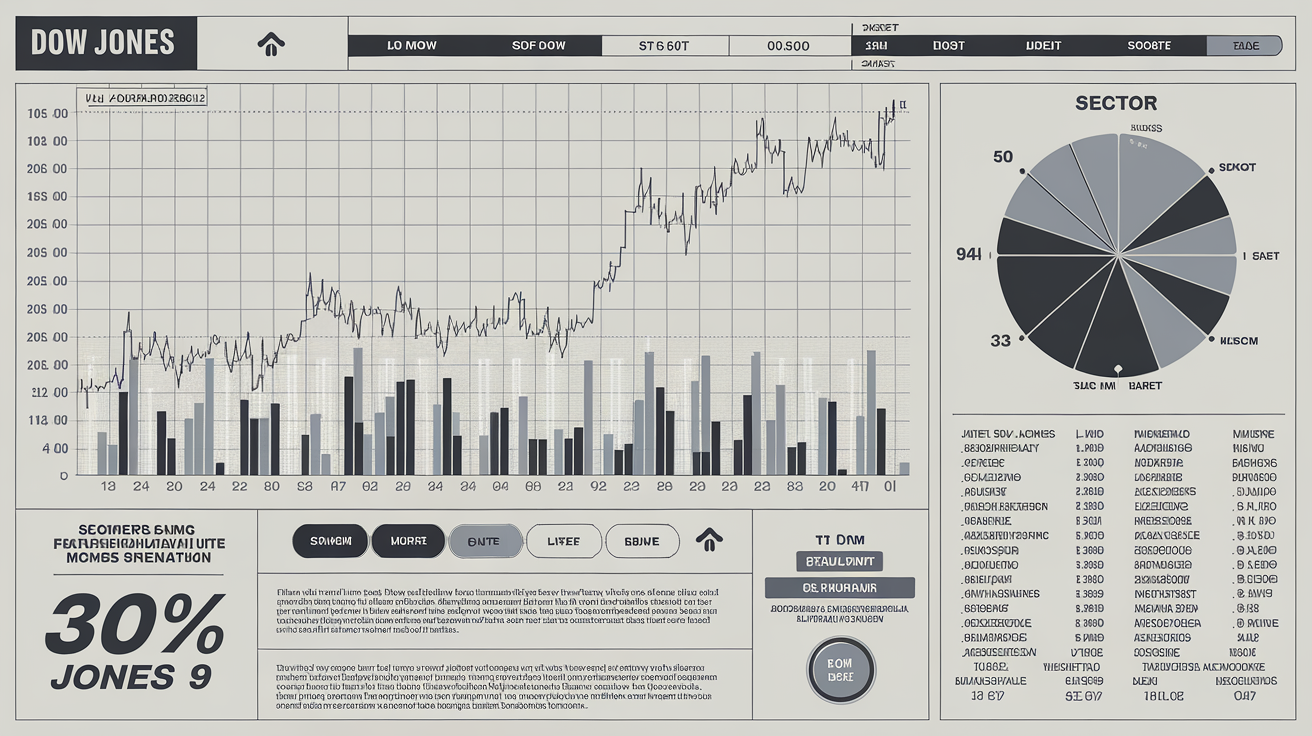

The Dow Jones is one of the most recognised stock market indices globally, acting as a barometer for the health of the US economy. Tracking the performance of 30 major companies, the Dow provides a snapshot of how large-cap stocks are performing across diverse sectors, from technology to healthcare and finance. Established over a century ago, it remains a critical tool for investors and economists monitoring it to understand market trends.

What is the Dow Jones?

The Dow Jones Industrial Average (DJIA), commonly referred to as the Dow, is a stock market index that reflects the performance of 30 large, publicly traded US companies. Unlike broader indices that track hundreds of companies, the Dow Jones focuses on a select few, carefully chosen for their influence and financial health. The index began in 1896 and was created by Charles Dow and Edward Jones to represent the US economy’s major industries. Although it initially included industrial companies, it has evolved to reflect other sectors, such as technology and consumer goods, that now play a pivotal role in the American economy.

How the Dow Jones Works

The Dow Jones operates on a price-weighted system, meaning the index’s value is based on the stock prices of its constituent companies rather than market capitalisation. This method gives companies with higher stock prices a more significant impact on the index’s value, regardless of size. The structure is unique among significant indices and contributes to the Dow Jones’ distinctive movement patterns compared to other indices, like the S&P 500, which weigh stocks based on market value.

As the economy changes, the Dow’s composition is occasionally adjusted. For example, as technology gained importance, the Dow added tech giants like Apple and Microsoft. This adjustment process keeps the Dow relevant and reflective of the American economic landscape.

Critical Components of the Dow Jones

The Dow Jones consists of 30 influential companies spanning various sectors, allowing it to represent the broader US economy. Here are some notable companies included in the Dow:

- Apple Inc. – Technology

- Microsoft Corporation – Software and services

- Goldman Sachs – Financials

- Johnson & Johnson – Healthcare

- Walmart – Retail

These companies are leaders in their respective fields and, through their performance on the Dow, help explain economic trends.

Why the Dow Jones Matters to Investors

For investors, the Dow Jones is an essential tool that helps them understand market conditions, assess economic health, and benchmark their investment performance. Since the index tracks well-established companies, many consider it a stable, reliable indicator compared to indices with smaller or newer firms.

Benefits for Investors:

- Economic Indicator: The Dow often reflects investor sentiment. A rising Dow generally signals optimism and economic growth, while a decline may reflect caution or financial challenges.

- Performance Benchmark: Many investors use the Dow as a yardstick for their portfolios, allowing them to see how their investments compare to the broader market.

- Historical Data: With over 100 years of data, the Dow provides insights into how the economy and markets have evolved, which investors can use to make informed decisions.

Historical Performance of the Dow Jones

The Dow Jones has reached numerous milestones, each telling a story about economic growth or downturns. In 1972, the Dow reached 1,000 points, marking substantial growth. Recently, it surpassed 30,000 points, reflecting the rapid development of US industries. Economic recessions and global events, such as the 2008 financial crisis and the COVID-19 pandemic, have caused the index to drop. Still, it typically rebounds over time, showing resilience in diversity.

The Dow Jones and the Global Economy

While the Dow Jones is a U.S.-focused index, its influence reaches globally. Significant changes in the Dow often impact international markets, representing some of the largest and most influential companies worldwide. A strong Dow can positively impact international investor confidence, while significant declines may trigger global market responses, showcasing the interconnectedness of global economies.

How to Invest in the Dow Jones

Investors can’t buy the Dow Jones directly but can invest in exchange-traded funds (ETFs) that track its performance. One popular option is the SPDR Dow Jones Industrial Average ETF (DIA), which mirrors the index’s movement. This allows investors to benefit from the Dow’s performance without purchasing each stock. Alternatively, investors can buy shares of companies listed in the Dow, giving them flexibility to pick companies they believe will outperform.

Conclusion

The Dow Jones remains a vital part of the US and global financial landscape, reflecting shifts in economic power and industry trends. Representing 30 of the largest and most established US companies, it offers insights into market sentiment and provides a reliable benchmark for investors. Whether you’re actively investing or staying informed, understanding the Dow Jones provides a valuable window into the health and direction of the economy.